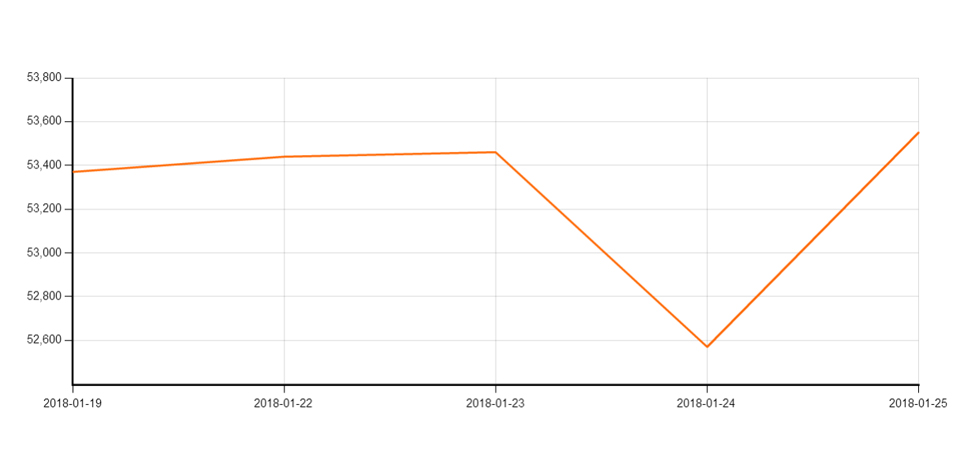

On this Wednesday, Shanghai Metal Exchange copper main contract jump empty low open 790CNY/ton to 790 CNY/ton, and further extended losses, late closed at 52730CNY/ton, plunged 1.84%, the copper choose down below the level in nearly two weeks oscillation range, fall is expected to expand further. In terms of term structure, the price of Shanghai copper 1803 contract and 1804 contract is narrowed to 130 CNY/ton.

Outside dish, the city of London copper oscillation rebounded, partly cut down yesterday, its losses as high as 2.49%, of which three months Aaron intraday trading at $6963 - $6912/ton, is currently trading at $6943/ton, rose 0.62%, its performance is a bit stronger than Shanghai copper, copper prices fell to effectively under the quad. In terms of positions, on January 22, the number of copper holdings was 328,000, with a daily decrease of 956, and the recent decline in copper prices showed that funds had fled from the copper market.

On the market side, on January 24, Shanghai electrolytic copper spot was posted to the monthly contract with a price of 20CNY/ton, and the copper price was 52540-52620 CNY/ton. Spot market appeared early in the morning but stranger inquiry to buy goods, early suppliers offer smooth water copper discount 80 CNY/ton, good copper discount 50CNY/ton, downstream quantitative order early and its suppliers and traders offer adhere to discount up to 60-20 CNY /ton, wet copper little and strong, with smooth water copper little spreads, offer discount in 80 CNY /ton. After that, the order has been gradually finalised in the downstream, and the rush of inquiry received a significant decline. Although most of the sellers still hold the firm's offer, they have been unsettled and the offer is relaxed. After 11 o 'clock, small shippers began to lower their prices, and the copper in pingshui has already seen a price of 90 to 80 CNY/ton. Good copper has fallen back to 40CNY/ton, but it is far from the early market. If copper prices continue to hover at 52,500CNY/ton in midweek, the downstream pickup is still expected, and the shippers are willing to hold the price to flat or even small premium.

On the macro side, the Asian dollar index continued its slide, trading around 89.94, effectively breaking the 90 mark, as other competitive currencies performed strongly, notably the pound and the euro. The focus is on France, Germany, and the U.S. manufacturing, services and composite PMI for January and the total annual sales of U.S. homes in December.

China's copper imports fell 19.8 per cent year-on-year in December, according to the general administration of customs, as the government continued to clamp down on scrap metal imports. In December, 260,000 tons of waste copper was imported, down 4.1% from 27.10 million tons in November. China's imports of scrap copper totaled 3.56 million tons in 2017, up 6.2 percent from 2016.

Within days, the Shanghai copper 1803 contract jumped to 52,860 CNY/ton, which was the lowest level in the year, indicating that the above pressure was heavier. After operation, Shanghai copper fell below the key technical support, back all quad under operation, suggested that Shanghai copper contracts back $1803 to $53500 for high altitude, under admission reference 53000 CNY /ton, focusing on 52300 CNY/ton.